maryland electric vehicle tax incentive

You can charge your EV at home if you have power where you park your car. Tax Credit Effective Dates.

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same.

. Search Federal and State Laws and Incentives. Search incentives and laws related to alternative fuels and advanced vehicles. Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges.

Eligible purchase price on plug-in fuel cell. The credit ranges from 2500 to 7500. Or 19 2 3000 FOR EACH ZEROEMISSION PLUGIN OR FUEL CELL ELECTRIC VEHICLE PURCHASED20 21 2 1500 FOR EACH PLUGIN ELECTRIC DRIVE HYBRID VEHICLE 22 PURCHASED.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Utility companies Pepco Potomac Edison Baltimore Gas and Electric BGE and Delmarva Power have each partnered with the state government to offer a 300 rebate for purchasing and installing an approved level 2 smart. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids.

You can search by keyword category or both. A Level 1 charger comes with most electric vehicles. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

If you drive an electric car hybrid or alternative fuel vehicle or are in the market to buy a fuel-efficient car read on for ways to. 3000 tax credit for each plug-in or fuel cell electric vehicle purchased. Battery capacity must be at least 50 kilowatt-hours.

For more general program information contact MEA by email at michaeljones1marylandgov or by phone at 410-598-2090 to speak with Mike Jones MEA Transportation Program Manager. For model year 2021 the credit for some vehicles are as follows. Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future.

Qualified PEV purchasers may apply for a tax credit against the imposed excise tax up to 3000. Maryland also has an incentive that allows electric vehicles to use high-occupancy vehicle HOV lanes no matter how many passengers are in the car. Clean Fuels Incentive Program CFIP.

Reduces consumption of imported petroleum by providing. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. This entitled qualifying car buyers to a tax credit of up to 3400 for purchasing a hybrid flexible fuel or plug-in hybrid electric vehicle PHEV between December 31 2005 and December 31 2010.

July 1 2017 - June 30 2020 Value of Benefit. Funding Status Update as of 04062022. Solar and Energy Storage.

Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. Maryland PEV purchasers between July 2017 to July 2020 Type of Incentive. Marylands incentive program Electric Vehicle Supply Equipment EVSE Rebate Program 20 grants rebates to individuals for home use businesses for employees and customers and retail service stations.

Maintenance cost for electric cars vs gas This incentive originally. The Credit Is For 10 Of The Cost Of The Qualified Vehicle Up To 2500. If you have any questions please email us at.

As an approved vendor with multiple utilities. Most if not all of the utility companies in Maryland offer a 300 rebate towards the purchase of a qualifying Level 2 charger that allows for time of use data sharing with the utility. 1500 tax credit for each plug-in hybrid electric vehicle purchased.

Delmarva power is projected to reach a significant milestone with the installation of more than 50 electric vehicle charging stations across its maryland service area by the end of 2021. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. STATE OF MARYLAND.

893 of the funds budgeted for the FY22 EVSE program period have been committed with 19258900 still available. Today federal law provides an EV incentive through the Qualified Plug-In Electric Vehicle PEV Tax Credit for new EVs purchased after December 31 2009. Plug-In Electric Vehicle PEV Tax Credit.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. EV and hybrid vehicle purchase incentives do benefit from some bipartisan support in Maryland and throughout the country. 18 1 The amount of excise tax paid for the purchase of the vehicle.

The utilities will then credit your bill for. If a single person purchases two eligible plug-in electric vehicles with tax credits up to 7500 for each vehicle they should be able to claim 15000 in. Read below for incentives available to Maryland citizens and businesses that purchase or lease these vehicles.

This charger plugs into a standard 120-volt outlets and it has the longest charging time. OR 23 3 I 1000 FOR EACH TWOWHEELED ZEROEMISSION. Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit.

Tax Incentives Registration or Licensing Fuel Taxes Loans and Leases Fuel Production or Quality. President Bidens EV tax credit builds on top of the existing federal EV incentive. EV and hybrid vehicle purchase incentives do benefit from some bipartisan support in Maryland and throughout the country.

How do I charge my vehicle. Maryland encourages residents to adopt eco-friendly driving habits by offering numerous green driver incentives ranging from emissions test exemptions to full-time high occupancy vehicle HOV lane access regardless of the number of passengers. Standard Rebate of 2500 for purchase or lease of a new electric vehicle with a base price under 50000.

Electric vehicle vs gas car tax. Charge Ahead rebate of 5000 for purchase or lease of a new or used electric vehicle with a base price under 50000 for eligible customers. Visit the Electric Vehicle Guide for help in choosing an EV model and finding rebates and tax incentives.

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Rebates And Tax Credits For Electric Vehicle Charging Stations

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Energy Administration

Manchin Objects To Federal Tax Credit For Union Made Electric Vehicles A Provision Of Biden S Social Spending Package The Washington Post

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Maryland Ev Tax Credit Extension Proposed In Clean Cars Act Of 2021 Pluginsites

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Incentives Maryland Electric Vehicle Tax Credits And Rebates

What S In The White House Plan To Expand Electric Car Charging Network Npr

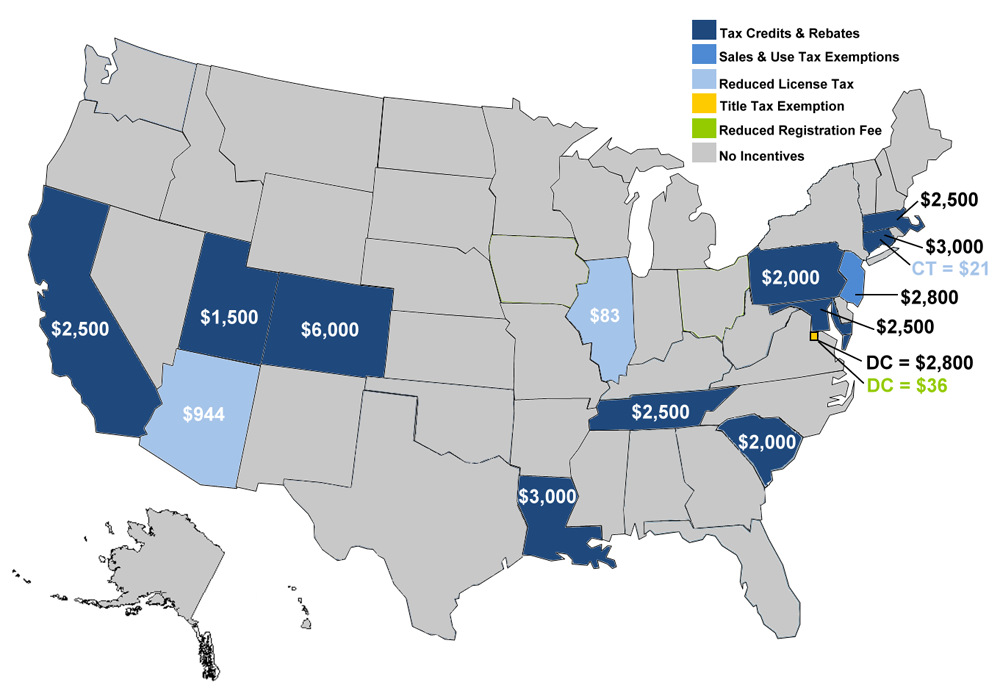

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Incentives Maryland Electric Vehicle Tax Credits And Rebates

Maryland Energy Administration

Electric Vehicles Charge Ahead In Statehouses Energy News Network

Fact 891 September 21 2015 Comparison Of State Incentives For Plug In Electric Vehicle Purchases Department Of Energy